AHFA is working on your behalf to collect the newest information, updated details and latest revisions to the resources you need for managing your business during the COVID-19 crisis.

------------------------------------------------

OSHA COVID-19 EMERGENCY TEMPORARY STANDARD

November 7, 2021

The U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) announced a COVID-19 Emergency Temporary Standard on November 5, 2021. Under this standard, which was effective immediately, all private sector employers with 100 or more employees must develop, implement and enforce a COVID-19 vaccination policy. However, the measure was immediately challenged, and the U.S. Court of Appeals for the Fifth Circuit granted an emergency motion to stay enforcement of the ETS on November 7.

The U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) announced a COVID-19 Emergency Temporary Standard on November 5, 2021. Under this standard, which was effective immediately, all private sector employers with 100 or more employees must develop, implement and enforce a COVID-19 vaccination policy. However, the measure was immediately challenged, and the U.S. Court of Appeals for the Fifth Circuit granted an emergency motion to stay enforcement of the ETS on November 7.

Jim Wimberley of Wimberly, Lawson, Steckel, Schneider & Stine, Atlanta, has provided a summary of the ETS. OSHA officials have said they are “fully prepared” to defend the ETS in court.

PPP LOAN FORGIVENESS GUIDE

May 20, 2020

Under the Paycheck Protection Program (PPP), loans may be forgiven if borrowers use the funds to maintain their payrolls and pay other specified expenses. This new step-by-step guide from the U.S. Chamber will calculate your loan forgiveness amount, help you navigate record-keeping requirements, and determine repayment terms on amounts not forgiven.

Under the Paycheck Protection Program (PPP), loans may be forgiven if borrowers use the funds to maintain their payrolls and pay other specified expenses. This new step-by-step guide from the U.S. Chamber will calculate your loan forgiveness amount, help you navigate record-keeping requirements, and determine repayment terms on amounts not forgiven.

Click HERE to download the PPP Loan Forgiveness Guide.

MANUFACTURING WORKER SAFETY & SUPPORT: INTERIM GUIDANCE FROM CDC AND OSHA

May 18, 2020

This document provides interim guidance from the Centers for Disease Control (CDC) and Occupational Safety and Health Administration (OSHA) for managing worker safety when a potential COVID-19 worker exposure has occurred. This guidance pertains to facilities that are part of the “critical manufacturing sector.” A link to CDC public health recommendations for facilities that are not part of the critical manufacturing sector also is included.

TREASURY REVISES ERTC GUIDANCE

May 7, 2020

The Internal Revenue Service updated its guidance related to the Employee Retention Tax Credit (ERTC), earlier this month, ruling that employers who have laid off or furloughed workers but continue to provide health care benefits do NOT qualify for the tax credit. The ruling stated that companies must be paying wages to employees in order to count the health plan expenses.

But Congressional tax writers objected to the guidance in a letter to Secretary of the Treasury Steven Mnuchin.

In a May 7 reply, Treasury official Frederick Vaughan, principal deputy assistant secretary in the Office of Legislative Affairs, said the department would revise its guidance and allow employers to remain eligible for the ERTC if they continue to provide health insurance.

STATE-BY-STATE BUSINESS REOPENING GUIDE

May 4, 2020

Developed by the U.S. Chamber in May, this state-by-state business reopening guide continues to be updated regularly. It reflects the latest back-to-work guidelines, including updates for those states that have reversed reopening plans due to a resurgence in COVID-19 cases.

From personal protective equipment (PPE) requirements to employee screening, the U.S. Chamber’s guide offers the latest information in an interactive map designed to assist U.S. employers in their decision-making.

MAIN STREET LENDING PROGRAM

April 30, 2020

The Federal Reserve has announced that it is establishing a Main Street Lending Program to support small and medium-sized businesses that were in sound financial condition before the onset of the COVID-19 pandemic.

The program will be open to companies with up to 15,000 employees, or up to $5 billion in annual revenue. Previously, the program was limited to companies with up to 10,000 employees and $2.5 billion in revenue.

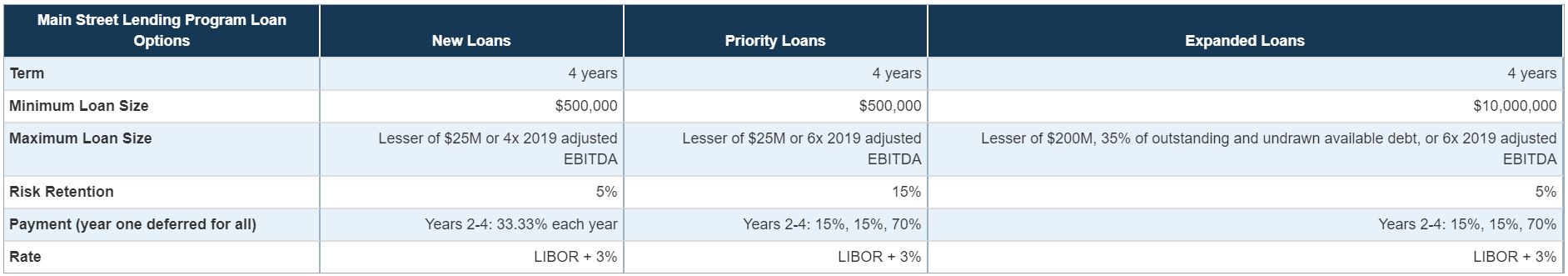

The program will operate through three facilities: the Main Street New Loan Facility (MSNLF), the Main Street Priority Loan Facility (MSPLF), and the Main Street Expanded Loan Facility (MSELF).

Term sheets for each facility and Frequently Asked Questions can be found HERE.

ADD YOUR VOICE!

April 17, 2020

AHFA is leading an effort to persuade federal and state officials to add home furnishings to the list of consumer products deemed “essential” for Americans during the COVID-19 pandemic. Add your voice to the effort by sending a letter to your legislators. AHFA makes it easy!

ASSISTANCE FOR SMALL BUSINESSES

March 27, 2020

The Paycheck Protection Program provided up to $349 billion toward job retention and certain other expenses. Current law dictated that this program close August 8, 2020. SBA is no longer accepting PPP applications from participating lenders.

- For a top-line overview of the program CLICK HERE.

- To find out if you qualify as a small business, CLICK HERE for the Small Business Administration’s Size Standards.

- If you’re a borrower, more information can be found HERE.

- For affiliation rules applicable for the Paycheck Protection Program, click here.

The Employee Retention Tax Credit is available to all businesses and tax-exempt organizations. Companies can take advantage of this in lieu of the SBA PPP loan program. It allows a 50% refundable tax credit (applicable to Social Security taxes) on up to $10,000 in wages per employee, per quarter. The equation changes to apply to furloughed employees if the business/non-profit has more than 100 employees.

- For an overview of the Employee Retention Tax Credit CLICK HERE.

- For an FAQ on the Employee Retention Tax Credit CLICK HERE.

- Form 7200 for applying for this tax credit.